The amount of wealth Americans have stored in their homes has increased astronomically. On average, homeowners gained $33,400 in equity over the last 12 months, and the average equity on mortgaged homes is now $216,000. When it’s time to sell, […]

Blog

Buyer & Seller Tips • Real Estate News • Market Trends

Infographic:

A look at home price appreciation through 2025

Home prices have increased significantly over the last year, which in turn has grown the net worth of homeowners. Appreciation and home equity are directly linked – as the value of a home increases, so does a homeowner’s equity. And […]

What to expect as appraisal gaps grow

In today’s real estate market, low inventory and high demand are driving up home prices. As many as 54 percent of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association […]

5 things buyers need to know when making an offer

When it comes to buying a house, you’re looking for the perfect place to call home. The problem is, in today’s market there just aren’t that many homes available to purchase. With inventory hovering near record lows and sky-high buyer […]

Infographic: Rent vs. Own

Owning a home has distinct financial benefits over renting. When you rent, you build your landlord’s wealth, your monthly payment depends on ever-rising rents, and you don’t benefit from home price appreciation. On the other hand, when you own your […]

Home price appreciation: As simple as supply and demand

Home price appreciation continues to accelerate. Today, prices are driven by the simple concept of supply and demand. Pricing of any item is determined by how many items are available compared to how many people want to buy that item. […]

Infographic: Should I buy now or wait?

If you’re thinking that waiting a year or two to purchase a home might mean you’ll save some money, think again. Mortgage interest rates are currently very low, but experts across the board are forecasting increases in both home prices […]

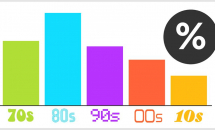

Mortgage rates by decade

Mortgage interest rates have dropped considerably over the past year, and compared to what we’ve seen in recent decades, it’s a great time to buy a home. Locking in a low rate today could save you thousands of dollars over […]

Infographic: Is now the right time to sell?

If you’re on the fence about selling your house, now is a great time to take advantage of sky-high demand, low supply, and fierce buyer competition. With buyer demand rising and historically low inventory for sale, if you’re in a […]

Infographic:

Winning as a Buyer in a Sellers’ Market

Buying a home in today’s sellers’ market doesn’t have to feel like an uphill battle. Here are four ways to make sure you’re positioned for success when making a home purchase, even when the scale tips toward sellers: Let’s connect […]

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- 8

- Next Page »