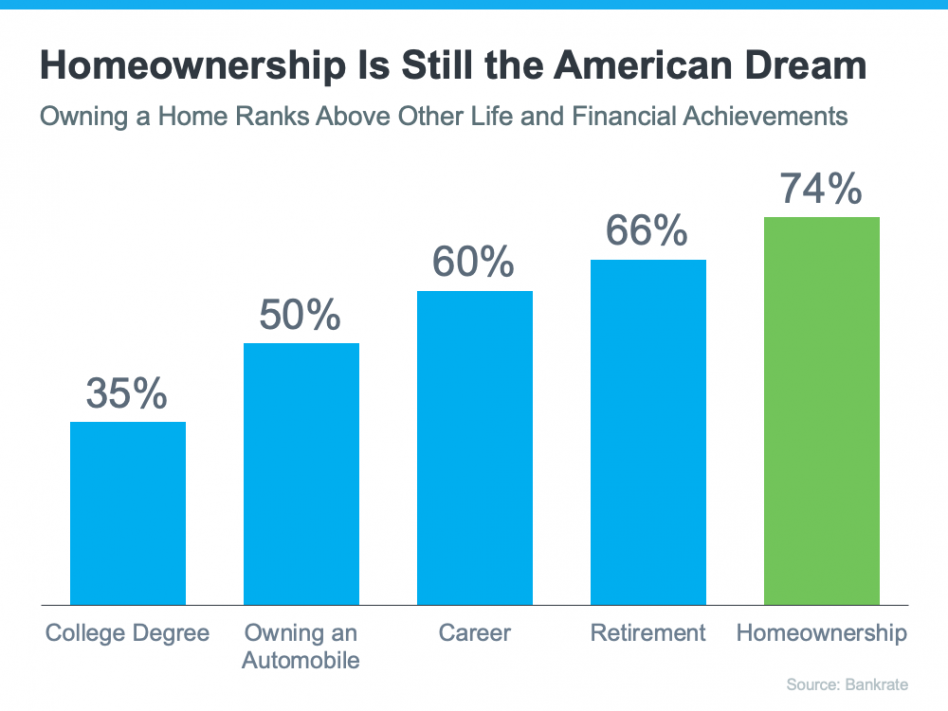

With all the headlines circulating about home prices and mortgage rates, you may be asking yourself if it still makes sense to buy a home right now, or if it’s better to keep renting. Here’s some information that could help put your mind at ease by showing that investing in a home is still a powerful decision.

According to the experts at Gallup, real estate has been crowned the top long-term investment for a whopping 12 years in a row. It has consistently beat out other investment types like gold, stocks, and bonds. Just take a look at the graph below – it speaks volumes:Continue Reading

![The Path to Homeownership [INFOGRAPHIC]](https://quailcreekhomes.com/assets/2021/07/kcm-path-to-home-ownership.png)