If you’re thinking of buying a home and not sure where to start, you’re not alone. Here’s a map with 10 simple steps to follow in the home buying process.

![The Path to Homeownership [INFOGRAPHIC]](https://quailcreekhomes.com/assets/2021/07/kcm-path-to-home-ownership.png)

Let’s connect today to discuss the specific steps along the way in our local area.

If you’re thinking of buying a home and not sure where to start, you’re not alone. Here’s a map with 10 simple steps to follow in the home buying process.

![The Path to Homeownership [INFOGRAPHIC]](https://quailcreekhomes.com/assets/2021/07/kcm-path-to-home-ownership.png)

Let’s connect today to discuss the specific steps along the way in our local area.

Filed Under: Home Ownership, Tips for Home Buyers Tagged With: Infographics

Congratulations! You’ve found a home to buy and have applied for a mortgage! You’re undoubtedly excited about the opportunity to decorate your new home.

But before you make any big purchases, move any money around, or make any big-time life changes, consult your loan officer. They will be able to tell you how your decision will impact your home loan. Following is a list of 7 things you shouldn’t do after applying for a mortgage! Some may seem obvious, but some may not!

1. Don’t make any large purchases like a new car or new furniture for your new home. New debt comes with it, including new monthly obligations. New obligations create new qualifications. People with new debt have higher debt to income ratios… higher ratios make for riskier loans… and sometimes qualified borrowers no longer qualify.

2. Don’t deposit cash into your bank accounts. Lenders need to source your money and cash is not really traceable. Before you deposit any amount of cash into your accounts, discuss the proper way to document your transactions with your loan officer.

3. Don’t change jobs or the way you are paid at your job! Your loan officer must be able to track the source and amount of your annual income. If possible, you’ll want to avoid changing from salary to commission or becoming self-employed during this time as well.Continue Reading

Filed Under: Tips for Home Buyers Tagged With: Credit, FICO Scores

There’s no arguing there’s costs associated with owning a home. But the opposite is also true; there are also definite costs associated with NOT owning a home.

The benefits of buying vs. renting has always been a hotly debated topic, with most people believing that — at least in the short term — renting is more cost effective. But most people don’t consider the hidden costs of not owning a home and sinking all of your money into your rental. Here are four sneaky ways that not owning a home will cost you:

When you own a home, there are no surprises when it comes to your monthly housing costs. Once you lock in your mortgage, your payment will remain constant throughout the length of your loan (unless you decide to refinance in the future). The stability of having a mortgage gives you the peace of mind of knowing what to expect each month — and not having to worry about unpleasant surprises that completely throw off your budget.

When you don’t own a home, you’re at the mercy of your landlord; they can (and often will) change the price of your rent often to keep up with market prices.

Everyone wants to feel comfortable in the place they call home — whether they own or rent. When you own a home, making the improvements necessary to make your home feel comfortable makes sense. Whatever you do to improve your home will only increase the value, making it a sound investment choice.

But when you don’t own your home, making improvements to your home is like throwing money away. If you paint your walls or hang too much art on the walls, you’ll likely have the cost of getting the property repainted deducted from your security deposit when you move out. Some landlords might not even allow you to make any improvements or changes at all.Continue Reading

Filed Under: Tips for Home Buyers, Home Ownership Tagged With: Rent vs. Own

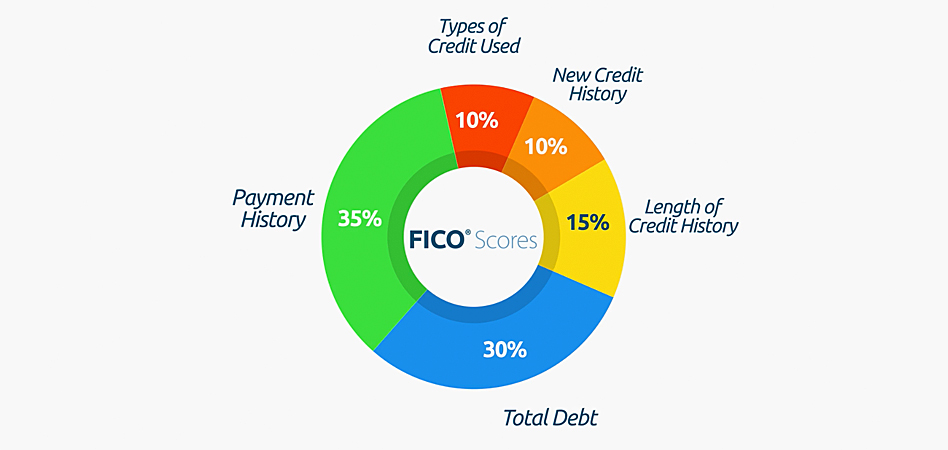

Are you about to apply for a mortgage loan in order to buy a home? If so, you may be curious about your FICO credit score and how this might affect your financing.

Here’s a look at how FICO scores can affect your mortgage and ways that you can boost your score to ensure your mortgage application is approved.

The Fair Isaac Corporation (FICO) is the country’s leading producer of credit scoring information and the primary source most lenders will check to assess how much risk you present. FICO combines information from credit bureaus such as TransUnion, Experian and Equifax and produces a score ranging from 300 to 850. The the better your credit history, the higher your score, and the lower the risk you present to lenders.

In general, many lenders find scores above 670 as indicating good creditworthiness. Typically, the higher your score, the lower the risk and the more likely creditors are to lend to you. If you have a score below 620 or 630 you may find it challenging to get approved and below 580 it will be almost impossible.Continue Reading

Filed Under: Tips for Home Buyers Tagged With: Credit, FICO Scores

A “Distressed” property is the industry term encompassing foreclosures, bank owned (REO) and short sales. Many people think that going after foreclosures, bank-owned or short-sale properties is a good way of getting a great deal on a home. It can be. But it can also be a risky purchase, and tough to even buy one, especially when financing.

Foreclosed homes are bank-owned properties that are usually sold at auction, where the bank tries to sell it for as much as possible to recover the money it lent.

Purchasing a foreclosure before it hits the open market (at an auction or Sheriff sale) requires that you take on all risk — they are sold “as is,” meaning no inspections, and no repairs. Oftentimes you can’t even see inside the home before you make an offer. And since most lenders won’t fund the purchase of foreclosed homes, purchasing with all cash is usually your only option.Continue Reading

Filed Under: Tips for Home Buyers Tagged With: Bank Owned (REO), Distressed Property, Foreclosure, Short Sale

A recent survey from Fannie Mae finds that a huge percentage of Americans are overestimating what it takes to secure a mortgage — and those misconceptions about mortgage qualifications could be holding people back from purchasing their dream home.

Fannie Mae’s survey aimed at exploring how well consumers understand the basic requirements for obtaining a mortgage. And what they found were a lot of misconceptions.

For example, the average consumer believes you need at lease a 10 percent down payment and a credit score of 650 to secure a mortgage — when, in reality, you only need a down payment of 3 percent and a credit score of 580 to qualify. Most consumers (a whopping 77 percent) aren’t even aware that low down payment mortgage programs exist.

The Takeaway: Don’t let your misconceptions about mortgages hold you back from buying your dream home. Getting a mortgage might be more attainable than you originally believed — even if you have a less-than-perfect credit score or a smaller down payment.

Filed Under: Tips for Home Buyers Tagged With: Credit, Down Payment, FICO Scores, Home Loans

It’s worth considering the many benefits of home ownership before you make the decision to rent or buy a home.

When you buy, you can stabilize your housing costs, own a tangible asset, and grow your net worth as you gain equity. When you rent, you face rising housing costs, won’t see a return on your investment, and limit your ability to save.

If you want to learn more about the benefits of homeownership, let’s connect today.

Filed Under: Home Ownership, Tips for Home Buyers Tagged With: Infographics, Rent vs. Own

Many headlines would have you believe that bidding wars and houses selling for over the asking price are a thing of the distant past. There have certainly been signs of the market softening a bit in favor of buyers, but bidding wars are still a thing, as well as houses fetching offers over asking price — even if it isn’t happening on every listing.

So if you’re a buyer right now, there’s still a good chance you’ve “lost” a house in a bidding war, and you’re still feeling the sting that comes with it. You may be wondering when (or if) the market will truly give you a fair shake at getting a house. Well, don’t lose hope! In fact, you may even get a second chance at a house you lost to another buyer.

According to a recent report by Axios, nearly 15 percent of pending home sales failed to close in June. Whether it was due to buyers not getting their mortgage, home inspection issues, the house not appraising for the sales price, etc., many sellers found themselves looking for a new buyer or going back to the buyers whose offers weren’t originally accepted.

So if you lost out on a house recently, there’s a chance you may get a second bite at the apple! If and when that happens for you, here are a few things to keep in mind:

Houses that are desirable and priced appropriately are still selling fast, with multiple offers, and often over asking price. So if you’re in the market to buy a home, you still need to be aggressive and make a strong offer. But if your initial offer isn’t accepted, don’t lose hope! If you find that the buyer they chose backs out and the seller checks to see if you’re still interested, be careful about lowering your offer, and don’t dismiss your second chance due to emotions or concerns about what was “wrong” with the house.

Filed Under: Tips for Home Buyers Tagged With: Bidding Wars, Multiple Offers

Today’s real estate market is incredibly competitive and, as such, many potential buyers find themselves competing with other buyers for the same property. Or, in other words, they find themselves in a bidding war — and how they navigate that bidding war can mean the difference between successfully purchasing their dream home, or losing out to another offer.

But what, exactly, is the right way to navigate a bidding war — and, just as importantly, what mistakes should buyers avoid if they want to successfully purchase a home? Here are a few common bidding war mistakes buyers are making in today’s market, including:

In today’s competitive housing market, you need a partner who can serve as your guide, especially when it comes to making a winning offer. Let’s connect so you have a trusted resource and coach on how to make the strongest offer possible for your specific situation.

Filed Under: Tips for Home Buyers Tagged With: Bidding Wars, Multiple Offers

It doesn’t matter if it’s a sellers’ market or one that’s more in favor of buyers; if a house is desirable and priced appropriately, the chances are you’re going to find yourself in a bidding war. Makes sense, right? If you love the house, most likely other buyers in the market will as well. So, not only do you have to act fast, but you need to pull out all the stops in order to get your offer accepted.

But that doesn’t mean you want to offer more than you have to in order to get the house! It’d be nice to be able to submit an aggressive offer that’ll beat out every other offer, yet not go more than a few bucks higher than the next highest offer, right? Well, you can pull that off with the use of what is known as an escalation clause.

Simply put, an escalation clause allows you to submit an initial lower offer, which will automatically increase in specific increments above any other offer that comes in, up to a certain capped amount you set.

For instance, if you made an offer of $300,000, and another offer came in at $310,000, if you had an escalation clause that said to offer $1,000 over any higher bid, your offer would go to $311,000. If nobody offered higher, your bid would effectively be the highest. But let’s say you capped it at $315,000. Your offer would continue to increase until someone exceeded that amount — but wouldn’t go higher — protecting you from paying more than you wanted to.

That said, while escalation clauses can be useful in helping you win a multiple offer situation, they can also cost you the house. So, let’s look at the pros and cons to using one, so you can decide if it’s the right decision for you:Continue Reading

Filed Under: Tips for Home Buyers Tagged With: Bidding Wars, Escalation Clause, Multiple Offers

I'm a Southern Arizona native and Quail Creek resident. Whether you’re buying or selling a home in Quail Creek, you’ll experience unsurpassed service and professionalism at all stages of your real estate transaction. I welcome the opportunity to assist in your next home sale or purchase.

Meet Russ

18745 S. I-19 Frontage Rd., Ste. A105

Green Valley, AZ 85614

(520) 333-0446

Contact Russ